April 2025 – On the heels of new tariff announcements, the steel market is experiencing significant volatility. On April 2, the U.S. administration expanded its tariff regime under a so-called “Liberation Day” policy. The new measures, aimed at broadening tariff coverage and pressuring trade partners, include:

- 10% universal tariff on all imports (effective April 5) (JPM_Corp_Advisory_Liberation_Day_Apr_6_2025.pdf)

- 25% tariff on imported automobiles and parts (effective April 3) (JPM_Corp_Advisory_Liberation_Day_Apr_6_2025.pdf)

- Higher “reciprocal” tariffs (11–50%) on 60 countries with high barriers against U.S. goods (effective April 9) (JPM_Corp_Advisory_Liberation_Day_Apr_6_2025.pdf)

These April tariffs are in addition to the existing 25% duties on steel and aluminum, further escalating global trade tensions. Trading partners have responded in kind (China announced a 34% counter-tariff, Brazil moved to enable retaliatory barriers, etc.), heightening uncertainty (JPM_Corp_Advisory_Liberation_Day_Apr_6_2025.pdf). Below, we assess how these developments are impacting steel markets – from surging prices and futures swings to softening demand indicators – and what it means for Atlas customers.

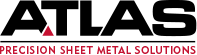

Steel Prices Surge on Tariffs and Tight Supply

Steel prices for hot-rolled, cold-rolled, and galvanized coil surged in Q1 2025. U.S. hot-rolled coil (HRC) jumped from around $700 per ton in January to roughly $940 per ton by early April (Steel Base Prices – Midwest – Phoenix Steel Service, Inc.) (Steel Base Prices – Midwest – Phoenix Steel Service, Inc.). Cold-rolled coil and galvanized sheet prices have likewise spiked – both climbing above $1,100/ton in the same period (Steel Base Prices – Midwest – Phoenix Steel Service, Inc.) (Steel Base Prices – Midwest – Phoenix Steel Service, Inc.). This steep run-up, illustrated in the chart above, reflects a tight physical market and tariff-driven cost pressures. Mills and service centers report that supply has tightened (due to earlier production cuts and modest imports), allowing tariffs to feed directly into higher transaction prices. Many manufacturers are now grappling with ~30–40% higher steel costs than just a few months ago, squeezing margins on projects in progress.

The CRU Midwest steel index – a key benchmark for HRC – confirms this uptrend. The index averaged around $930/ton for March (the March futures settlement) and has climbed to nearly $970/ton in the first week of April, its highest level since late 2021. Fast-rising spot prices are forcing buyers to either absorb higher costs or seek alternative sourcing. Some Atlas customers have accelerated purchases to build inventory before prices rise further, while others are taking a wait-and-see approach in hopes that the spike will be short-lived. This pricing volatility makes it crucial to monitor quotes closely and communicate with suppliers about any pending increases or lead time impacts.

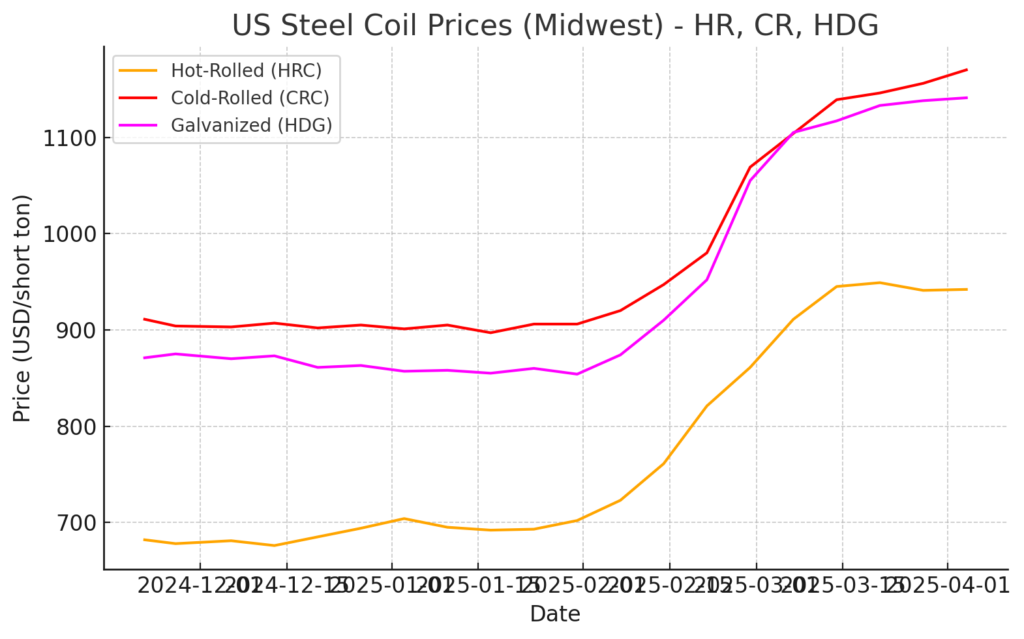

Futures Market Signals a Pullback Ahead

The forward curve for CME hot-rolled coil futures shifted downward by late March (white line) compared to early March (blue) and February (orange), signaling expectations of lower prices ahead. After an initial price spike, the steel futures market is now flashing more bearish signals. In mid-March, CME HRC futures rallied sharply – the April 2025 contract even reached an intraday high around $976/ton (HR Futures: Uncertainty hangs over the steel market – Steel Market Update) – anticipating that tariffs would keep pushing prices up. However, by the end of March, forward prices retreated significantly. Futures for May and June 2025 settled closer to the $800/ton range (HRC Steel Futures Continuous Contract – HRN00 – MarketWatch), well below the current spot market. In other words, the curve is in backwardation: near-term steel prices are higher than prices for later in the year. This indicates that traders expect today’s elevated prices to cool off in the coming months, once immediate supply shocks and panic-buying subside.

The result is an unusual spot-vs-futures disconnect. While the physical CRU index sits near $950, futures six months out are $150+ lower. Such a gap suggests that many market participants view the Q1 price surge as unsustainable. Reports from steel trading desks note that hedge funds and some end-users are even taking short positions (betting on a decline in steel prices) given the record-high premium of spot over future values. For buyers, this dynamic could be a silver lining – if the futures market is correct, relief in steel costs may arrive later in 2025. However, timing is uncertain, and there is always the risk that futures are underestimating the impact of tariffs if supply stays constrained.

Aggregate open interest in U.S. HRC futures hit multi-year highs in Q1 2025, reflecting a surge in hedging activity (Source: Bloomberg). Alongside these price moves, trading activity has skyrocketed. Open interest (the number of outstanding futures contracts) surged to over 40,000 contracts – the highest level in years (HR Futures: Market coiled and ready to move in 2025? – Steel Market Update). This spike in participation (see chart above) signals that both steel consumers and speculators rushed to hedge their price risk after the tariff announcements. Increased liquidity is generally a healthy sign for the futures market, as it improves price discovery. Indeed, the heavy volume and high open interest suggest a robust debate between bulls and bears: some players are locking in steel at current high prices (fearing further rises or needing certainty for projects), while others are positioning for a downturn. For Atlas and our customers, the takeaway is that the futures market is actively being used to manage risk right now – a reflection of just how uncertain the pricing outlook has become.

Softening Demand Signals and Buyer Sentiment

Despite the tariff-fueled price boom, demand indicators are flashing caution. Key metrics in the manufacturing sector have softened this spring, hinting that end-use consumption for steel may slow. The Institute for Supply Management’s Manufacturing PMI dipped to 49.0% in March, back into contraction territory (below 50) (Manufacturing PMI at 49%, wood and furniture dip | Woodworking Network). According to the ISM report, new orders, production, and backlogs all declined in March as manufacturers face economic headwinds (Board Converting News, April 7, 2025 – Page 24) (Board Converting News, April 7, 2025 – Page 24). Notably, prices for inputs surged – the ISM Prices Index jumped to 69.4%, its highest in over a year (Board Converting News, April 7, 2025 – Page 24) – “prices growth accelerated due to tariffs, causing new order placement backlogs, supplier delivery slowdowns and manufacturing inventory growth,” the ISM survey chair reported (Board Converting News, April 7, 2025 – Page 26). In other words, tariffs have contributed to rising costs and prompted some companies to build inventory early (to get ahead of the tariffs), even as their own order books are thinning. This divergence (rising input costs, falling demand) is squeezing manufacturers and could foreshadow a broader pullback in steel requirements if it continues.

Atlas is also hearing more cautious tones from customers. Many OEMs and fabricators are re-evaluating their steel needs for Q2 and Q3. Rather than secure large quantities at today’s high prices, some are opting to “wait it out”. In fact, evidence of a buyer’s strike is emerging in spots – certain service centers report that clients are deferring orders, expecting that steel prices will eventually come down. As one industry analysis noted, steel buyers may even “delay purchases if they believe the increases are unsustainable” (Steel Price Increases: Nucor and U.S. Steel Lead The Way). This bearish sentiment is a double-edged sword: it could help cool off prices (as demand pauses), but it also raises the risk of sharper price drops later if many purchasers hold off at once. For now, the mood among Atlas’s customer base is one of heightened caution – projects continue, but there is a greater focus on cost control, and some non-urgent steel orders are being postponed in hopes of a better pricing environment in a few months.

Planning Ahead and Customer Support

In this volatile setting, strategic planning is more important than ever. Atlas Manufacturing remains committed to guiding our customers through the turbulence. We are continuously monitoring steel price indices, mill lead times, and policy updates to inform our sourcing strategies. If you have questions about how these tariff changes might affect your material costs or project timelines, or if you need guidance on sourcing alternatives and timing, please reach out to us. Contact Nawal Whig at Atlas for expert support with steel sourcing and project planning. Our team is here to help you navigate these market impacts – from evaluating forward buys or stockpiling options to adjusting project schedules – so that you can move ahead with confidence despite the uncertainty. Together, we’ll work to mitigate the risks and keep your projects on track.